Democrats secured the support of Arizona Senator Kyrsten Sinema last night, meaning they now appear to have the 50 votes required to move forward with their Inflation Reduction Act.

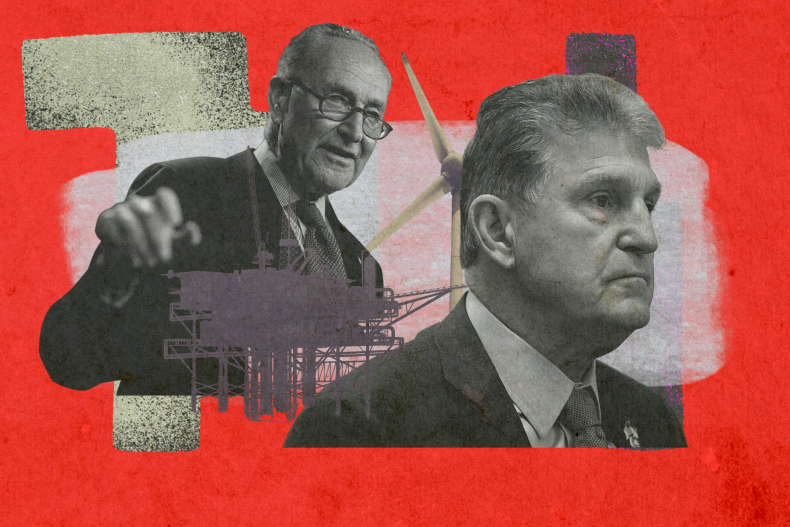

Formed out of a deal struck last week between Senate Majority Leader Charles Schumer and Democratic Senator Joe Manchin of West Virginia, the bill is expected to raise over $700 billion through tax and prescription drug pricing reforms. It will also spend over $360 billion on "energy security and climate change" investments.

If passed, this act would be the largest climate change package to ever make it through Congress. In it are provisions aimed to bolster domestic manufacturing of solar panels, wind turbines, batteries, and critical minerals processing. Other funds are allocated toward tax credits and loans that aim to reduce carbon emissions within "every sector of the economy."

At the consumer level is $9 billion in home energy rebate programs and a provision for 10 years of tax credits to help homes become more energy efficient. These are programs that Democrats say will relieve consumers of high energy costs, decreasing their overall utility bills.

For a party that has faced severe political backlash for historically high gas prices, these provisions could spark a much-needed political turnaround as Democrats head into the 2022 midterm elections holding slim majorities in the House and Senate.

Republicans have taken a hard stance against the bill, arguing that it will damage the energy sector and drive-up prices for oil and gas. All 50 Republican senators are expected to vote against it.

"It raises royalty rates on federal lands, which will discourage more production on federal lands," Republican Senator James Lankford of Oklahoma, who sits on the Energy and Natural Resources committee, told Newsweek. "People will just go to private lands, and so, it actually decreases income to the taxpayer."

"It discourages people from doing advancement in that area, which may affect the production," he added. "About 25% of the production traditionally that we get for oil and gas is from those federal lands. If you discourage more production on federal lands by raising the cost to actually produce there, then you discourage more production, and that'll have an effect on prices."

Although gas prices have fallen somewhat in recent weeks, the average cost per gallon across the nation remains above $4.00 — and is a top concern for voters. Inflation continues to batter consumer wallets, and most people believe the country is in the midst of a recession.

Democrats believe the Inflation Reduction Act, if passed, will help bring inflation under control. Early reviews of the bill's potential effectiveness in that regard are mixed.

Preliminary estimates from University of Pennsylvania's Penn Wharton Business Model (PWBM) project that the bill "would reduce non-interest cumulative deficits by $248 billion over the budget window with no impact on GDP in 2031." The report states that "the Act would very slightly increase inflation until 2024 and decrease inflation thereafter," but argues that the effect would be negligible.

"These point estimates [of inflation reduction] are statistically indistinguishable from zero," the report states, "thereby indicating low confidence that the legislation will have any impact on inflation."

The Tax Foundation, a conservative think tank based in Washington, D.C., estimates that the bill will produce a net increase of $304 billion in revenue (taking into account the cost of increased individual and business tax credits) while having negligible impact on long-run GDP (-0.1%) and wages (-0.1%).

As in the Wharton model, the Tax Foundation projects that the bill will actually increase inflation in the short term.

"By increasing spending, the bill worsens inflation, especially in the first two years, as revenue raisers take time to ramp up and the deficit increases," the report states.

The bill would increase federal spending by about $260 billion over 10 years, offset by tax increases of some $326 billion over the same period, according to an analysis by The New York Times of a report on the bill by the nonpartisan congressional Joint Committee on Taxation.

The bill contains extensive climate and energy provisions, including household tax rebates and credits, funding for wind turbines, solar panel and battery production, as well as tax credits for reduction of carbon emissions, according to the PWBM. It also includes a provision to let Medicare "negotiate the price of certain prescription drugs," a change with wide public support that has been debated in Congress for years.

Additionally, the IRS receives $80 billion in increased funding over the next 10 years under the bill for "enforcement activities including the hiring and training of new auditors, IT systems modernization, and taxpayer services," the PWBM reports.

The royalty and leasing provision in the bill, referred to as the "Mineral Leasing Act Modernization," would increase federal onshore oil and gas royalty payments from 12.5% to 16.67%. The bid price per acre of land leased for two years, as outlined in the Gas Leasing Reform Act of 1987, would jump from $2 to $10. And annual rental rates would jump from $1.50 an acre to $3.00 for the first two years of a lease, among other changes.

Drawing on an estimate compiled by industry trade association groups, Senator Lankford said the bill could see the cost of natural gas increase by 17%. In September 2021, in wake of discussions around the Build Back Better Act, 28 trade associations, including the Independent Petroleum Association of America (IPPA), wrote a letter to congressional leadership stating a methane tax in that bill would lead to this 17% spike. An outreach arm of the IPAA made this claim again regarding a similar provision in the new bill.

The Environmental Protection (EPA) reports that methane, which is released in the production of natural gas, "causes more than 1 million premature deaths in the U.S. every year," and the United Nations Environment Programme "methane has accounted for roughly 30 percent of global warming since pre-industrial times."

Katie Tubb, a research fellow with The Heritage Foundation's Center for Energy, Climate, and Environment, told Newsweek that the bill will not only harm the oil and gas industry but the energy sector as a whole. She argues that this bill "is increasing the federal government's decision-making power in the sector," specifically in regard to the bill's tax credits.

"From my perspective on energy policy, I think the production tax credit, the investment tax credit have been incredibly harmful for the wind and solar industries," she said, "specifically because of these boom bust cycles that are dependent on political action as opposed to what is actual customer demand."

But Trevor Higgins, vice president of climate policy at the Center for American Progress, argues that the investments contained in the bill will help stabilize the industry and put America on course to reduce the costs of energy.

Higgins told Newsweek that the bill is significant because it's structured to ensure that clean energy tax credits are not just extended retroactively or for two years, as they have been in the past, but rather puts them in place for 10 years. He said the credits contained in the bill are also more flexible than those of the past and will support expansion of the clean energy sector.

Manchin contends that hikes in gas prices will be offset by a promise Schumer made that the party would next look at addressing the oil permit process in a move aimed to increase production. Both Lankford and Tubb have doubts that Democrats will follow through on that promise.

Democratic Senator Mark Kelly of Arizona, who serves alongside Manchin on the Energy and Natural Resources committee, feels confident that the Party will follow through.

"I've called on this administration a number of times to increase oil and gas production, and also on industry to increase oil and gas production," he told Newsweek. "They can do that too, and there has been some of that, but there needs to be more of it."

Kelly dismissed concerns that the measure will hurt the oil and gas industry.

"Often someone will point to some minor thing that has no impact and say that it has a big impact," he said.

Kelly argues that the bill supports environmental clean-up while also reducing costs by offering viable alternative energy sources.

"Reducing greenhouse gases by 40% in eight years is significant, and it's important for the climate," he said. "Reducing costs right now for Arizonans is high on the list, and getting new forms of energy, feeding the grid, will ultimately reduce the price of electricity."

"Ten years from now, this transition [to clean energy] is going to be well underway," Higgins told Newsweek. "The prospects for further clean energy development going into the following decade are even brighter because we'll have this new manufacturing capacity, we'll have irreversible trend towards zero emission vehicles, and we'll be demonstrating to the rest of the world solutions that will work over there also."

In addition to expanding the clean energy sector's capacity, Higgins said it will present greater economic opportunity across the United States through the bolstering of domestic manufacturing in a move that will allow the country to better compete with China.

Within the bill are tax credits aimed to support U.S. industries that are not directly tied to clean energy. For example, Higgins notes, it requires solar panel manufacturers to use U.S.-produced steel when creating their products. There are also investments specifically targeting manufacturing that will bolster America's ability to create the ancillary components needed for clean energy technologies, including batteries for electric cars.

Over the past few decades, China has come to dominate the production of solar panels, which Higgins said has put domestic manufacturers out of business. The Manchin-Schumer deal aims to address this by offering domestic manufacturing incentives and ensuring that solar panel firms actually go to these producers as they source parts in order to receive the tax credits outlined in the bill.

"This is kind of a new paradigm for confronting the strategic investments that China has made to try and dominate the solar panel industry," Higgins told Newsweek. "This bill is going to invest in batteries, solar panels and wind turbines and all of the tools that we need to have a secure, robust American supply chain to support our competition in the emerging global clean energy market."