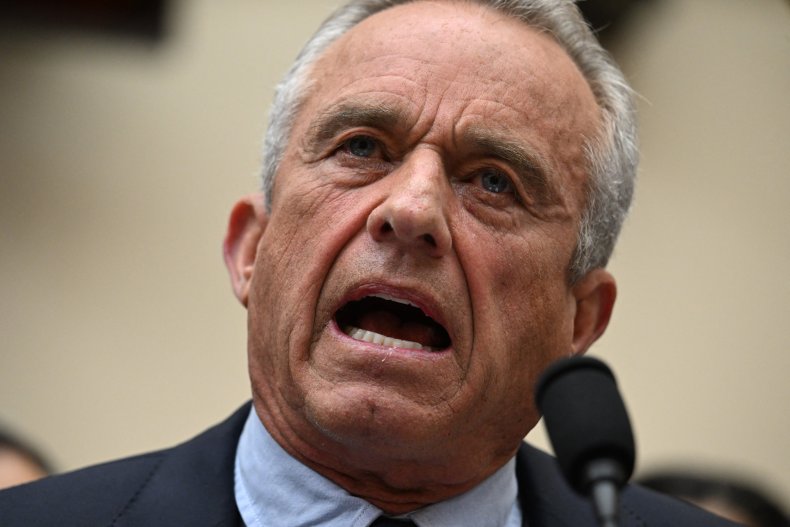

Robert F. Kennedy Jr.'s proposal to back the U.S. dollar with Bitcoin has been slammed by cryptocurrency experts, with one economist telling Newsweek the plan is a "near-impossible feat" that would restrict the Federal Reserve's ability to respond to an economic crisis.

Speaking earlier this month at an event hosted by the Heal the Divide Super PAC, which has ties to prominent Donald Trump-supporting Republicans, Kennedy claimed that backing the dollar with hard assets, including bitcoin, would "rein in inflation and usher in a new era of American financial stability, peace and prosperity."

Kennedy is currently running for the 2024 Democratic presidential nomination, though polling puts him a significant margin behind President Biden who is seeking a second term in the White House. An environmental campaigner turned vaccine skeptic, Kennedy is using his campaign to challenge what he perceives as an ongoing attack on free speech and to oppose the military aid that the Biden administration is sending to Ukraine.

Addressing Heal the Divide, Kennedy said: "My plan would be to start very, very small, perhaps 1 percent of issued T-bills would be backed by hard currency, by gold, silver platinum or bitcoin."

T-bills are short-term government debt obligations sold by the Treasury Department, with the money used to support state spending.

Kennedy also vowed to "exempt the conversion of bitcoin to the U.S. dollar from capital gains taxes," arguing this would create more jobs in America and safeguard free expression.

"Non-taxable events are unreportable and that means it will be more difficult for governments to weaponize currency against free speech, which as many of you know, is one of my principal objectives," he said.

Newsweek reached out to Robert F. Kennedy Jr. via email for comment.

Jean-Paul Lam, a cryptocurrency expert and associate professor at the University of Waterloo in Canada, hit out at a policy he described as "essentially a return to the gold standard."

"Having Bitcoin as a currency backer to any national currency would be a nearly impossible feat given all the issues associated with Bitcoin, such as price volatility, security and limited flexibility," Lam told Newsweek.

"However, the primary and possibly fatal drawback of having a Gold-Bitcoin Standard is that it would severely restrict the ability of the Federal Reserve Bank to respond to economic downturns and provide necessary monetary stimulus during crises. For example, just envision how the Federal Reserve would have responded during the 2008-09 financial crisis or Covid under a Gold Standard (it would have been unable to prevent an economic catastrophe).

"The drawbacks of the Gold Standard far outweigh any benefits we might get from it. This matter has been thoroughly debated and settled. It is not worth further discussions," Lam said.

Billy Bambrough, a senior Forbes contributor specializing in cryptocurrencies, also raised concerns, telling Newsweek that Kennedy's plan would create "a level of uncertainty that markets would find very hard to handle."

"As the U.K. saw recently when short-lived prime minister Liz Truss tried to go against the economic status quo, unorthodox or unconventional economic policy can cause market turmoil and make holding those positions unsustainable," Bambrough said.

Bambrough noted that Kennedy's campaign had put "the right to create, buy, sell and hold digital assets like bitcoin on the [presidential] ballot for the first time."

Speaking in May at the Bitcoin 2023 conference, Kennedy described Bitcoin as "both an exercise and a guarantee" of civil liberties. He said: "As president, I will make sure that your right to hold and use Bitcoin is inviolable."

Brian McGleenon, the host of Yahoo Finance's The Crypto Mile podcast, told Newsweek that if implemented, Kennedy's proposals would cause the value of Bitcoin to surge.

"Kennedy has indicated his intent to support approximately 1 percent of issued U.S. Treasury bills with a hard currency, like bitcoin," McGleenon said. "Such a move would pour a substantial allocation of capital into an asset class whose market capitalization stands only at $566 billion. As a result, Bitcoin's value would significantly surge, its cup would overflow, and potentially rival the market cap of gold, currently estimated at nearly $13 trillion.

"This shift would also have profound implications for global monetary policies. Central banks might revert to a revised Bretton Woods system, with bitcoin replacing gold. However, with current bitcoin allocation concentrated in the hands of a few individuals, the system would create a new power hierarchy that incumbents would dislike."